Best Savings Account

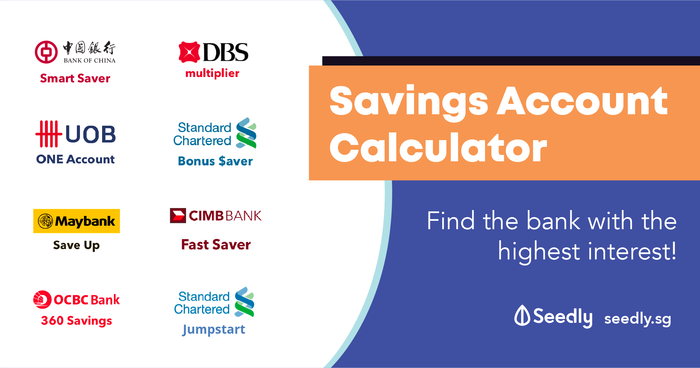

Here are the best online savings account interest rates. If you are looking for a low-risk way to save money over a long period of time, high yield savings accounts may be a good option for you. Best Rates on Savings. At Third Federal, our High-Yield Savings Account can pay you the highest rate. You can open this account as a regular savings account or as an IRA account—the choice is yours. Either way, the High-Yield Savings Account offers: No Monthly Fees; No Limit on Monthly Transactions; Easy Access to Your Funds. Interest rates on savings accounts vary greatly, which means you need to shop around to find your best rate available. It’s possible to find rates reaching well past 2%, while the average savings account rate stands at around 0.27% (as of April 2020).This is why we check rates daily at more than 5,000 U.S. Banks and credit unions, to make it easy for you to gain the best possible return on. A savings account is a bank or building society account that pays interest on your money. It’s a good way to make your cash work harder than it might do in a current account, Some current accounts pay attractive rates of interest but usually have conditions attached, such as having to pay in a certain amount each month and running direct debits. National savings average rate courtesy of the FDIC’s Weekly National Rates and Rate Caps, as of; average rate used is for deposits under $100,000. Barclays Online Savings Annual Percentage Yield (APY) is valid as of XX/XX/XXXX. No minimum opening balance or deposit required to open. Fees could reduce the earnings on the account.

Hello.

Opening an ABLE account today means you invest in your future without losing benefits.

In the past, the risk of losing public benefits coupled with the high cost of support expenses, limited members of the disability community from building financial security. UNTIL NOW.

Eligible individuals may now open a CalABLE account and manage their money on this website that provides you a tax-advantaged account, easy access to your money using the CalABLE Visa® Prepaid Card,* and confidence your savings, up to $100,000, won’t affect your eligibility for programs like SSI and Medi-Cal.

/shutterstock_229464280-5bfc361946e0fb00260d1974.jpg)

As State Treasurer, I am devoted to ensuring California’s most worthy and vulnerable citizens have the same opportunity to achieve financial stability as those without disabilities. Through CalABLE, we are achieving that vision.

Sign up today for your tax-free treatment on earnings and withdrawals to pay for disability-related expenses, and let us help you dream, plan and succeed in your most ambitious goals.

In peace and friendship,

Best Savings Accounts 2021

Fiona Ma, CPA

California State Treasurer

*The CalABLE Visa Prepaid Card is issued by MetaBank®, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc.

Best Savings Account 2020

1167578