Eurodollars

At times, it is beneficial for a person or organization to hold bank deposits denominated in U.S. Dollars (USD) at a bank that is outside of North America. These dollars are referred to as Eurodollars. Despite the name, there isn't anything necessarily European about Eurodollars. They are also completely unrelated to the Euro currency. A deposit in Japan or Argentina, denominated in dollars, would still be called a Eurodollar deposit. Most such accounts are held in Europe, but many are held in east Asia and in the island nations of the Caribbean.

The main advantage of Eurodollars is the fact that they are free of any regulation imposed on U.S. banks by the Federal Reserve, which is the central bank of the United States. Among other things, this means that banks which hold Eurodollar deposits do not have to pay deposit insurance premiums on these deposits. They are also free of the obligation commonly known as a reserve requirement. Banks in the U.S. are legally required to keep a certain percentage of depositor funds on hand as cash, and are permitted to loan out the rest. Being unfettered by the reserve requirement lets more Eurodollars be lent out to borrowers.

Reflecting market expectation for interest rates, Eurodollar futures are a global benchmark and a fundamental building block of the interest rate marketplace, while options on Eurodollar futures are. Eurodollar definition is - a U.S. Dollar held as Eurocurrency.

Eurodollars Futures Contract

The process by which Eurodollars are transferred around the world can be a complex one, especially to someone unfamiliar with finance. One important thing to remember about this process, though, is that while foreign banks may hold deposits denominated in U.S. Dollars, Eurodollars never actually leave the United States. A foreign bank with a Eurodollar deposit holds that deposit at a U.S. bank, in the same way a bank customer would, but this asset is balanced by the fact that the deposit is still owed to the person whose money it is. In other words, the net effect of Eurodollars on a foreign bank's balance sheet is zero. In this sense, the deposit stays in the U.S. the whole time.

Eurodollar Cyberpunk

The first Eurodollars were created in the 1950s as an indirect result of the expanded foreign holdings of dollars following World War II. Apart from foreign deposits of dollars, some countries, including the Soviet Union, had deposits in American banks. Following certain events of the Cold War, the Soviet government was fearful that its assets in the U.S. would be frozen.

Eurodollars Are Primarily Used In

To protect against this possibility, some Soviet holdings were transferred to a Soviet-owned bank that had a British charter, with the idea that the British bank would in turn deposit the money in American banks. This way, the Soviets could still have assets in the U.S., and they would be protected from seizure by the fact that the money was directly controlled not by the Soviets, but by Britain. On 28 February 1957, the first Eurodollars were created in this way, in the amount of an $800,000 USD deposit.

Eurodollars Wiki

When our clients see Eurodollars futures being traded in their CTA accounts, they sometimes think that it is the Euro/USD currency pair. Eurodollars actually have nothing to do with Europe’s currency. Eurodollars are interest bearing bank deposits denominated in US Dollars and held at banks outside of the United States. Since these bank deposits are held outside the U.S., they are outside the jurisdiction of the US Federal Reserve, and subject to less regulation. Due to this, the higher level of risk to investors is reflected in higher interest rates.

The Eurodollar Futures contract started trading on the Chicago Mercantile Exchange (CME) in 1981, marking the first cash settled futures contracts. When Eurodollar futures contracts expire, the seller of the contract can transfer the associated cash position rather than making delivery of the underlying asset.

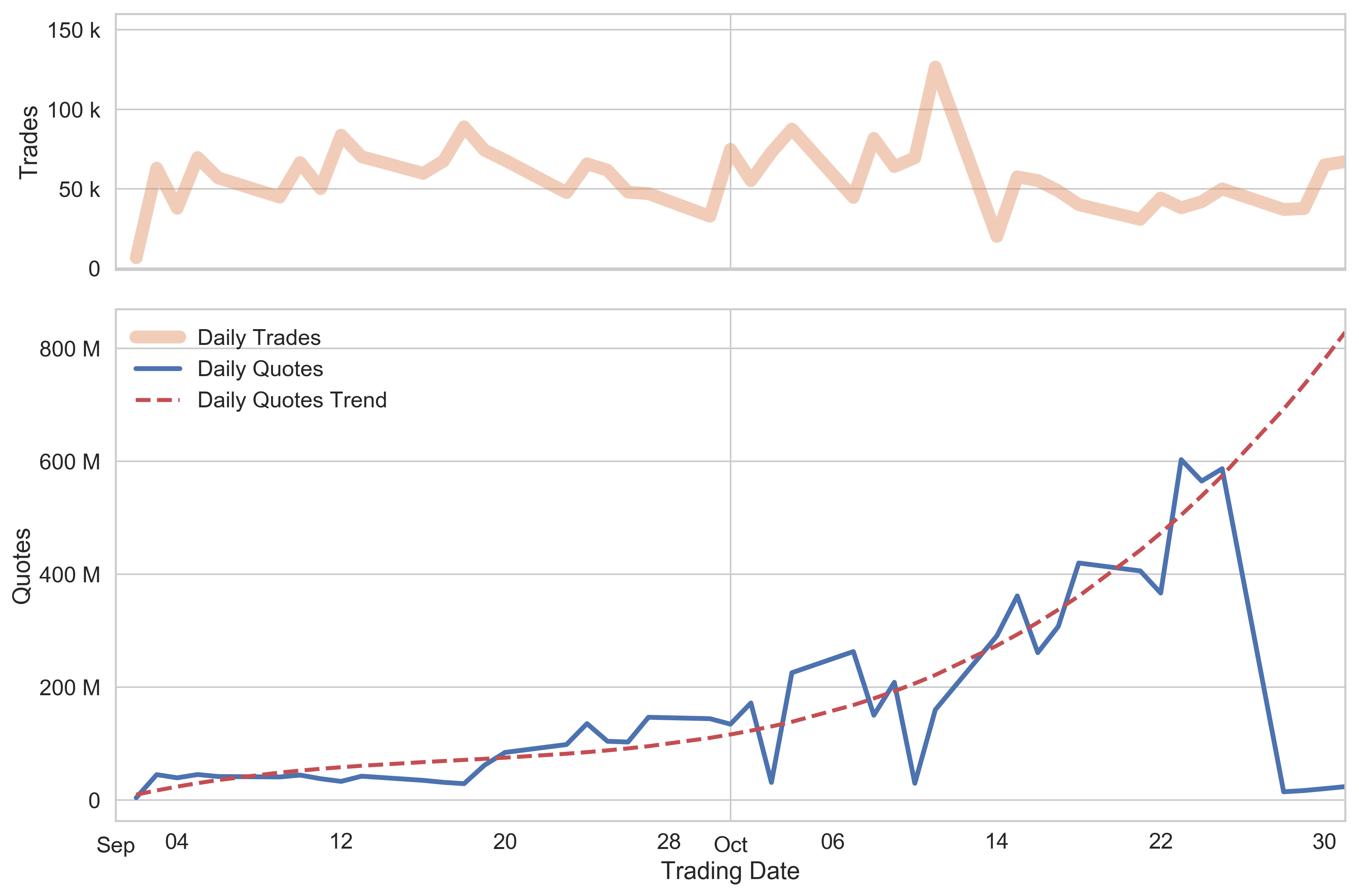

What do Eurodollar futures measure? The underlying instrument in Eurodollar futures is a eurodollar time deposit having a principal value of $1,000,000 with a three-month maturity. Eurodollar futures provide an effective means for companies and banks to secure an interest rate for money it plans to borrow or lend in the future. The Eurodollar contract can be used to hedge against interest rate changes over multiple years into the future. If interest rates rise, Eurodollar futures decrease, and if interest rates fall, Eurodollar futures increase. Here is a current chart of December 2018 Eurodollar futures:

As you can see Eurodollars futures are currently trading around 97.40, which implies an interest rate of 2.60% in December 2018. If expected eurodollar interest rates in December 2018 were to rise to 3.60%, then December 2018 Eurodollars futures contracts would be trading down around 96.40.

As an interest rate product, the policy decisions of the US Federal Reserve have a major impact on the price of Eurodollar futures. Trading Eurodollar futures can be quite volatile around FOMC meetings and announcements. A long-term change in Fed policy towards raising interest rates would lead to Eurodollar futures declining steadily over the long-term (making it a good trade for trend followers).