State Bank Of India Fixed Deposit Rates

The State Bank of India is the largest Indian bank with 42 crore customers. It offers a wide list of products and services to customers including savings accounts, fixed deposits, loans and credit cards. It has been ranked as 236th in the Fortune Global 500 list of the world's biggest corporations of 2019. Get all the details on Bank Fixed Deposits in India, List of Banks for Fixed Deposits, Interest Rates, Fixed Deposits Rating, Fixed Deposits Schemes and Bank Fixed Deposits 2021. Business Fixed Deposit Account. Rates applicable from the 18 th December 2017. Business Fixed Deposit Account (GBP) Annual / Maturity AER; For Balance (£ 5000 - £ 250,000) 1 Year: 1.00%: 1.00%. State Bank of India (SBI) is authorised and regulated by Reserve Bank of India and Prudential Regulation Authority. Subject to regulation by the. At present, the Union Bank FD rates on senior citizen fixed deposit account range from 4.0 percent to 5.95 percent. Union Bank of India FD rates are based on the RBI monetary policies, Bank's liquidity position, and credit demands along with the economic growth rate. Fixed deposit rates revised by SBI. The State Bank of India has reduced the interest rates on fixed deposits from 27 May 2020 by 40 basis points across all tenures. A fixed deposit for a tenure of 1 year will now offer an interest rate of 5.10% compared to 5.50% earlier.

- Extremely competitive interest rates

- Variety of CD terms and accounts available

- High minimum deposit

- Limited physical locations

- Residents of New York looking for great rates

State Bank of India New York (SBI) is just one of the many overseas offices established under the original, Mumbai-based financial institution. Founded in 1806, State Bank of India currently offers more than 22,000 branches in India and operates 195 overseas offices. The New York office, which was founded in 1970, offers a variety of banking products. In addition, the office specializes in corporate credit, trade finance, and deposits and remittances. The bank’s deposit focus area covers products like checking accounts, money market accounts and certificate of deposit (CD) accounts. Furthermore, SBI’s CDs, which offer some of the best CD rates, come with terms ranging from three months to five years. They additionally branch into three different categories: Retail, Corporate and Senior Citizen certificates.

If you’re looking for more convenient banking options, SBI also offers an online banking feature. Through SBI’s online banking service, you can fulfill basic actions like opening accounts, making deposits or completing transfers.

SBI Retail Certificates

SBI’s Retail certificates function as the bank’s standard CD accounts. With terms from three months to five years, the Retail certificates require a $5,000 minimum to open. Additionally, the bank requires $5000 minimum for personal, U.S. based consumer accounts, while they require $10,000 for accounts of businesses. All Retail CD terms produce competitive interest rates. So if you don’t mind the $5,000 minimum, then you could significantly grow your wealth with a SBI account.

| Retail CD | Minimum Deposit | APY | |

| 3 Month | $5,000 | 0.10% | Compare CD Rates |

| 6 Month | $5,000 | 0.20% | Compare CD Rates |

| 12 Month | $5,000 | 0.50% | Compare CD Rates |

| 2 Year | $5,000 | 0.60% | Compare CD Rates |

| 3 Year | $5,000 | 0.70% | Compare CD Rates |

| 4 Year | $5,000 | 0.75% | Compare CD Rates |

| 5 Year | $5,000 | 0.90% | Compare CD Rates |

SBI Corporate Certificates

Similar to its Retail certificates, SBI also offers Corporate certificates with terms ranging from three months to five years. These CDs also require a minimum of $5,000 to open. Strictly for corporate deposits, these certificates additionally allow you to earn at a fixed-rate annual percentage yield (APY). This means that your money will grow at the same rate that you opened your CD with. While market fluctuations typically lead to varying rates, you’ll be locked into the same rate you started with.

| Corporate CD | Minimum Deposit | APY | |

| 3 Month | $5,000 | 0.10% | Compare CD Rates |

| 6 Month | $5,000 | 0.20% | Compare CD Rates |

| 12 Month | $5,000 | 0.25% | Compare CD Rates |

| 2 Year | $5,000 | 0.35% | Compare CD Rates |

| 3 Year | $5,000 | 0.40% | Compare CD Rates |

| 4 Year | $5,000 | 0.45% | Compare CD Rates |

| 5 Year | $5,000 | 0.60% | Compare CD Rates |

SBI Senior Citizen Certificates

The third and final CD rates option SBI offers are its Senior Citizen certificates. These CDs come with relatively shorter terms than the previously listed accounts. In addition, its maturities range from one to five years. Finally, the Senior Citizens CDs also allow users to earn at greater APYs than they would with the same maturities for SBI’s other two account options.

| Senior CD | Minimum Deposit | APY | |

| 12 Month | $5,000 | 0.60% | Compare CD Rates |

| 2 Year | $5,000 | 0.70% | Compare CD Rates |

| 3 Year | $5,000 | 0.80% | Compare CD Rates |

| 4 Year | $5,000 | 0.85% | Compare CD Rates |

| 5 Year | $5,000 | 1.00% | Compare CD Rates |

2-Year Retail CD Interest Rate Comparison

Compare State Bank of India to Other Competitive Offers

Overview of SBI CDs

While most of SBI’s CD terms and rates are generally competitive, you’ll earn greater return with longer terms. In addition, all of SBI’s CD accounts offer great rates, so you’ll typically earn at decent APYs no matter which maturity you choose. Furthermore, all SBI CDs are FDIC-insured up to $250,000.

For withdrawals made on a CD before it reaches maturity, SBI charges early withdrawal penalties. For instance, if you make an early withdrawal on a CD with a maturity of at least five years, you’ll lose 180 days’ worth of interest. However, there’s an easier way for you to continue growing your wealth through a CD. You can do this by having your account automatically renewed. For instance, SBI will automatically renew your account unless you notify them otherwise.

How Much You Earn With SBI Certificate of Deposits Over Time

Though SBI offers high-yield rates, the bank compounds interest quarterly on all CD accounts. Therefore, your wealth won’t build upon itself as fast as it would if it were compounded daily or monthly. However, you’ll still earn at higher APYs with SBI than you would with other competitors. You can basically generate decent return no matter what term you choose. In addition, larger deposits will produce a greater return. However, you’re likely to generate more savings growth if you start with the 12-month maturity mark.

| Initial Deposit | 6-Month CD | 12-Month CD | 60-Month CD |

| $1,000 | $1,001 | $1,005 | $1,045.82 |

| $2,500 | $2,502.50 | $2,512.50 | $2,614.54 |

| $5,000 | $5,005 | $5,025 | $5,229.09 |

| $10,000 | $10,009.99 | $10,050 | $10,458.18 |

How SBI CD Rates Compare to Other Banks’

Though SBI provides highly competitive rates, other competitors like Capital One, also offer similarly high-performing rates when you compare CD rates. Additionally, though solely an online bank, Marcus by Goldman Sachs also generates comparably high interest rates.

While SBI requires a $5,000 minimum deposit, Capital One doesn’t require any for its CDs. In addition, Capital One CD terms range from six to 60 months and compound interest monthly. Furthermore, Capital One allows you to invest in up to 50 CDs simultaneously, while SBI only authorizes you to invest in one.

Marcus by Goldman Sachs also offers similarly competitive rates. For a minimum deposit of $500, you’ll be able to select from a variety of CD terms. Marcus’ longer-term CDs also generate greater returns.

| CD Account | SBI (Retail) | Capital One | Marcus by Goldman Sachs |

| 6 Month | 0.20% | 0.20% | 0.60% |

| 1 Year | 0.50% | 0.20% | 0.55% |

| 3 Year | 0.70% | 0.30% | 0.55% |

| 5 Year | 0.90% | 0.40% | 0.60% |

Should You Get a SBI CD Account?

Overall, if you’re a resident of New York and don’t mind SBI’s $5,000 minimum deposit, you should consider opening one of its CDs. SBI offers highly competitive rates with three different CD account options for its users to select. In addition, each of its CD terms come with high-yield rates, so you can generally earn decent savings growth despite which term you choose.

Bank Fixed Deposits (FDs) are the safest forms of investment. They are not only risk-free but also flexible as banks allow you to withdraw the amount prematurely when in need. There are different types of FDs in the banks such as the short-term deposits and long-term deposits. The short-term deposits are usually for periods less than six months where the banks give you simple interest on the principal investments. The long-term deposits are re-investment kind of deposits where the bank pays you interest on compound basis.

Calculating the compound interest is a complex mathematical operation. The process is extremely difficult and time-consuming. Plus, the results so derived are prone to human calculation errors. Thus, you can use an FD Calculator to determine the interest you receive on maturity of such deposits. One such user-friendly calculator is the SBI fixed deposit calculator. SBI FD Calculator allows you to calculate the total interest you’ll receive upon maturity of your deposit and plan your investment accordingly.

Features and Benefits of SBI FD Calculator

State Bank of India (SBI) offers two kinds of fixed deposits: non-cumulative FD and cumulative FD. The periodic interest payment option is the first one whereas the second category is the reinvestment option. Calculating the interest payment in the periodical option category is easy because SBI uses the simple interest calculation formula. However, you will need the help of the SBI FD calculator to arrive at the maturity amount in the reinvestment category. Let us now look at the features and benefits of the SBI fixed deposit calculator.

The formula for calculating the maturity amount with compound interest is a challenging one to understand and determine. The SBI FD calculator makes your job easy.

SBI Fixed Deposits Interest Rates

State Bank of India is the largest public sector bank in India. It offers various fixed deposit products to its customers at attractive rates of interest. The SBI interest rates change at frequent intervals. Similarly, they have different rates of interest depending on the principal deposit amount. This interest rate table will make things clear.

Below ₹ 1 Crore w.e.f. 28.11.2018

| Deposit Tenure | General | Senior Citizen |

| 7 to 45 days | 5.75% | 6.25% |

| 46 to 179 days | 6.25% | 6.75% |

| 180 to 210 days | 6.35% | 6.85% |

| 211 days to < 1 year | 6.40% | 6.90% |

| 1 year to < 2 years | 6.80% | 7.30% |

| 2 years to < 3 years | 6.80% | 7.30% |

| 3 years to < 5 years | 6.80% | 7.30% |

| 5 years to 10 years | 6.85% | 7.35% |

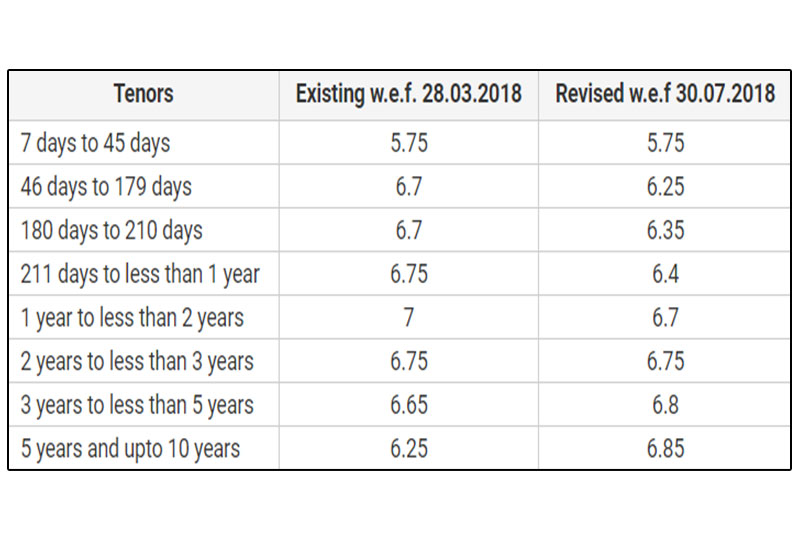

Bulk Term Deposits between ₹ 1 Crore and ₹ 10 Crores w.e.f. 30.07.2018

| Deposit Tenure | General | Senior Citizen |

| 7 to 45 days | 5.75% | 6.25% |

| 46 to 179 days | 6.25% | 6.75% |

| 180 to 210 days | 6.35% | 6.85% |

| 211 days to < 1 year | 6.40% | 6.90% |

| 1 year to < 2 years | 6.70% | 7.20% |

| 2 years to < 3 years | 6.75% | 7.25% |

| 3 years to < 5 years | 6.80% | 7.30% |

| 5 years to 10 years | 6.85% | 7.85% |

Bulk Term Deposits above ₹ 10 Crores w.e.f. 30.07.2018

| Deposit Tenure | General | Senior Citizen |

| 7 to 45 days | 5.75% | 6.25% |

| 46 to 179 days | 6.25% | 6.75% |

| 180 to 210 days | 6.35% | 6.85% |

| 211 days to < 1 year | 6.40% | 6.90% |

| 1 year to < 2 years | 6.70% | 7.20% |

| 2 years to < 3 years | 6.75% | 7.25% |

| 3 years to < 5 years | 6.80% | 7.30% |

| 5 years to 10 years | 6.85% | 7.35% |

Important points to note

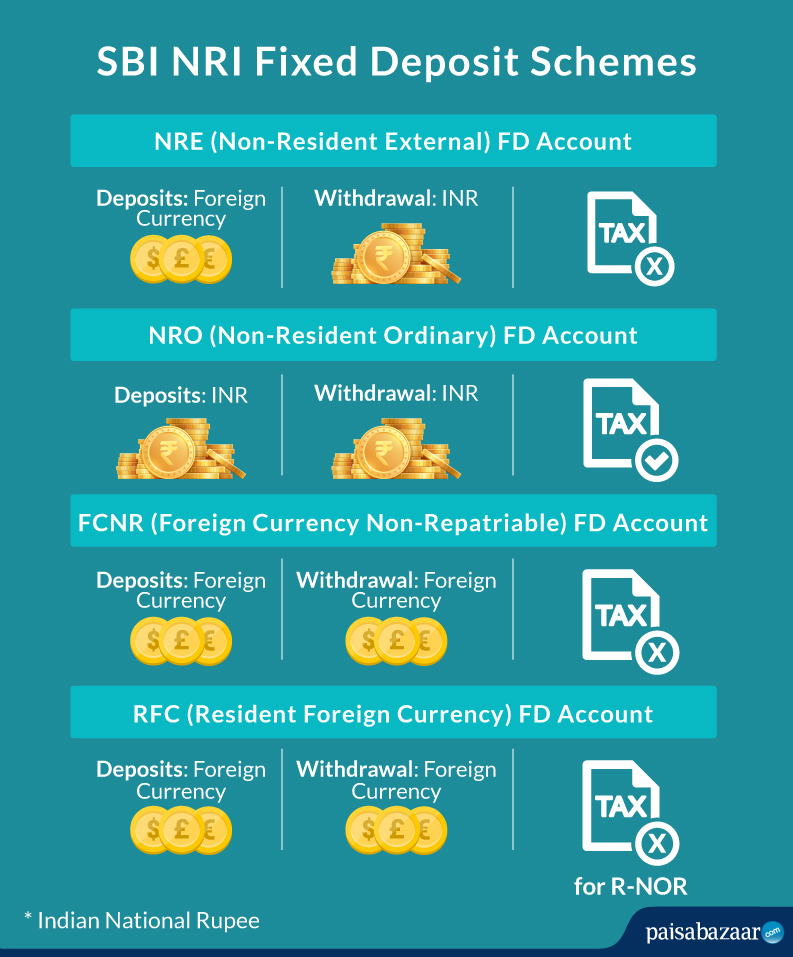

- NRO and NRE deposits have a different rate structure.

- There is a premature withdrawal penalty of 1% for the bulk term deposits.

- Staff members and ex-staff of State Bank of India get an additional interest of 1% on all fixed deposits.

How to calculate the interest with Online SBI FD Calculator

Calculating the applicable interest is a complicated process. It is best to use the SBI Fixed Deposit Calculator to determine the maturity amount and the interest you earn from the deposit. Here is the process explained in a few steps.

- Enter the principal amount, the rate of interest, and the deposit tenure.

- The next step is to choose the interest frequency options. The available options are simple, monthly, quarterly, half-yearly, and annually.

- On clicking the ‘Calculate’ button, you get the maturity amount and the amount of interest.

Tax on SBI Fixed Deposit

The interest received on bank FDs is taxable. You have to include the interest as a part of your income while preparing your Income Tax returns. The income tax rate depends on the slab you fit into while computing your taxable income.

The Income Tax Act 1961 stipulates that banks and other financial institutions should deduct tax at source while paying interest on fixed deposits placed with them if the amount of interest paid to the individual depositor is more than ₹ 10,000 in a financial year. All branches of a bank constitute a single identity. The TDS rate is as follows.

- 10% if you update the PAN details in your account

- Otherwise, the rate is 20%

The banks are under an obligation to deposit the TDS amount to the Income Tax department at fixed intervals. Consequently, the banks furnish the details of the TDS deposited with the IT Department to the depositor vide Form 15G and 15H. You can use these details while preparing your IT returns and claim refunds if applicable.

If your annual income does not come in the tax bracket, you can submit Form 15G (General Public) or 15H (Senior Citizen) along with your PAN details to the banks. The banks do not deduct TDS under such circumstances.

Eligibility Criteria for SBI Fixed Deposits

State bank of India has the most extensive network of branches in India. You are never far away from a State Bank of India branch wherever you are in India. Hence, a significant proportion of the Indian population prefers to open fixed deposit accounts with the SBI. The following categories of entities can open fixed deposits with SBI.

- Individuals – Resident as well as Non-Resident Indians can open FDs in SBI in single or joint names.

- Non-individuals like sole proprietorship, partnership firms, companies, Government departments, clubs, societies, trusts, and associations

Fixed Deposit Rates In India

One should compulsorily satisfy KYC norms while opening FD in SBI. It is also advisable to avail the nomination facility for your convenience. Ensure to update your PAN details and submit the necessary 15G/H forms if you do not come in the tax bracket.

Use the SBI FD calculator to determine the maturity amount and the interest you earn on your deposit.