Synchrony Bank Cd Rates

Wire transfer to your Synchrony Bank account (must be initiated by the sending bank). Personal or cashier’s check. Fill out a deposit slip (which you’ll get in your Welcome Kit from us) and mail the check and deposit slip to: Synchrony Bank. The current interest rate displayed is for deposit amounts of over $100,000. MetLife Bank deposit accounts have moved to GE Capital Retail Bank (Now Synchrony Bank). The rate of 2.50% is 1.27%. You can withdraw interest paid during your CD’s current term anytime without penalty. You can transfer the interest to a Synchrony Bank High Yield Savings or Money Market Account or a non-Synchrony Bank account. For help withdrawing your interest, call us at 1-866-226-5638.

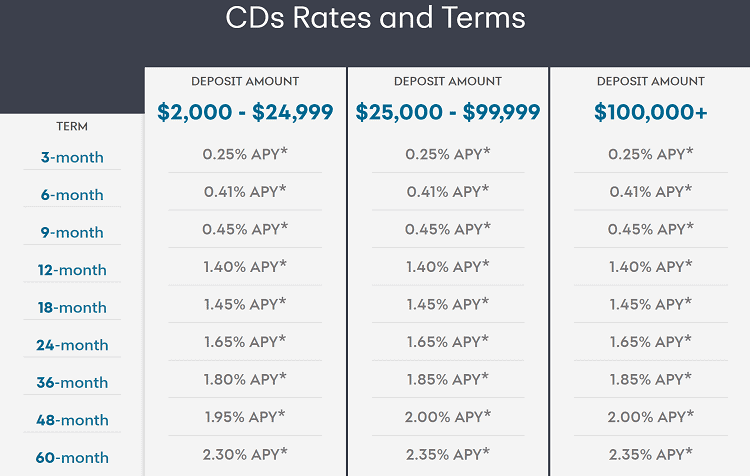

© adriaticfoto/Shutterstock An older couple researches online.Synchrony Bank is an online bank that offers a variety of savings products, including certificates of deposit (CDs). Synchrony offers a wide range of CD terms. The minimum deposit for each CD is $2,000.

Synchrony is best for savers who are comfortable banking only online.

Synchrony Bank Cd Rates 2019

Synchrony Bank earned 4.2 out of 5 stars.

Synchrony CD rates

Here's a closer look at Synchrony's CD rates.

| Account name | Term | APY | Minimum deposit |

| CD | 3 months | 0.15% | $2,000 |

| CD | 6 months | 0.25% | $2,000 |

| CD | 9 months | 0.35% | $2,000 |

| CD | 12 months | 0.60% | $2,000 |

| CD | 13 months | 0.60% | $2,000 |

| CD | 14 months | 0.60% | $2,000 |

| CD | 15 months | 0.60% | $2,000 |

| CD | 18 months | 0.60% | $2,000 |

| CD | 24 months | 0.65% | $2,000 |

| CD | 36 months | 0.70% | $2,000 |

| CD | 48 months | 0.70% | $2,000 |

| CD | 60 months | 0.80% | $2,000 |

Synchrony Bank Certificate Of Deposit

Video: 7 Things You Should Do Before Claiming Social Security (Money Talks News)

Note: The APY (annual percentage yield) shown is as of Dec. 23, 2020. The APYs for some products may vary by region.

How Synchrony rates compare to top-yielding banks

Synchrony has the advantage of offering a wide variety of terms, but the interest rate it pays for CDs is slightly lower compared to some other high-yield CDs offered by other banks. That means you can easily set up a CD ladder, but might not earn as much as you otherwise could.

If you're looking to maximize the interest you earn, consider a CD with another bank, such as Delta Community Credit Union or VyStar Credit Union. Which bank offers the highest yields on CDs depends on the term. Shop around.

Other savings options at Synchrony

Synchrony also offers savings accounts and money market accounts.

The money market account offers a lower interest rate than the bank’s 12-month CD. Unless you value the flexibility that a money market accounts offer, the account isn't a great choice for savers seeking the highest rate.

Synchrony's savings account is a good option to earn a solid return without locking your money into a CD. The savings account currently offers higher rates than the bank’s money market account and even the bank’s 36-month CD. It also beats out the rates offered by many competitors, making it a good way to earn a solid return without locking your money into a CD.